Your Utilities Costs Can Decrease

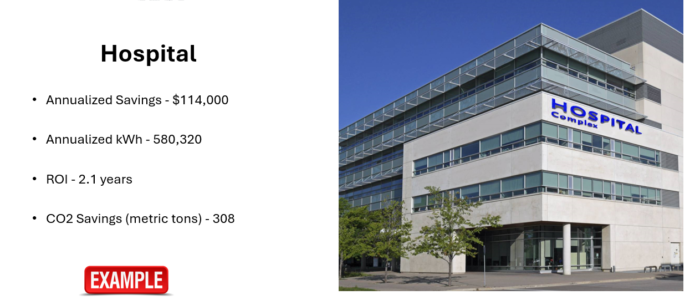

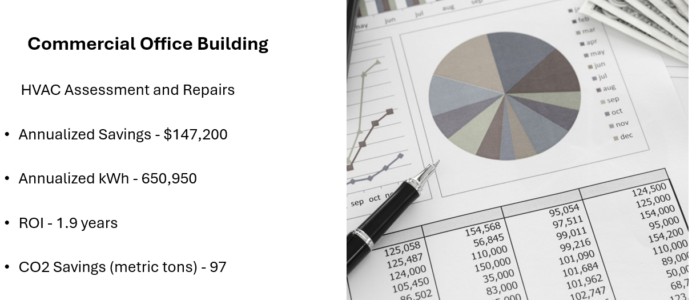

The financial case for energy optimization is compelling by any standard. Few investments available to building owners and managers can match the possible returns generated by building efficiency improvements. Consider the numbers: strategic energy efficient upgrades and retrofits can potentially deliver returns of 10% – 30% on invested capital, with possible payback periods as short as 1-3 years for building mechanical, electrical, plumbing and AI building management software improvements. This translates to an investment that can continue to generate strategic returns.

Annual Returns on Your Investments

Beyond the direct energy savings, efficiency improvements can trigger a cascade of financial benefits throughout your property. Reduced maintenance costs result from newer, more operationally efficient and reliable equipment. Equipment life extends when operated more efficiently. Perhaps most significantly, property values can increase, and energy-efficient buildings can command rental premiums along with selling prices higher than comparable inefficient properties.

Energy efficiency is a strategic investment, it’s an investment that enhances asset value, improves competitive positioning, and can deliver financial returns.

The economic advantages extend further through available incentives and rebates. Many states offer financial incentives for commercial energy improvements, with utility rebates, tax incentives, inducements and financing programs that can offset project costs. These incentives effectively can help your return on investment, turning good financial decisions into productive returns.

In today’s economic climate, few investments can match these returns, making energy efficiency not just environmentally responsible, but financially imperative.